Market Truths

December 27, 2015

After a tumultuous week in global markets, today the US stock market ended higher on the session. On the heels of macroeconomic data that showed strong fundamentals in the US, along with overtures from China to slow its downturn, the Standard & Poor’s 500 gained 3.9% and the Nasdaq (which includes Apple, Google, Intel and other tech stalwarts) gained 4.2%.

As a former investment banker who followed the markets closely once upon a time (especially when I was in the midst of public market M&A transactions), I now have the luxury of watching from an arm’s length. After the market downturn on Monday I set several limit orders – primarily on tech holdings that I wanted to increase positions in – in my personal account and went back to meeting with entrepreneurs.

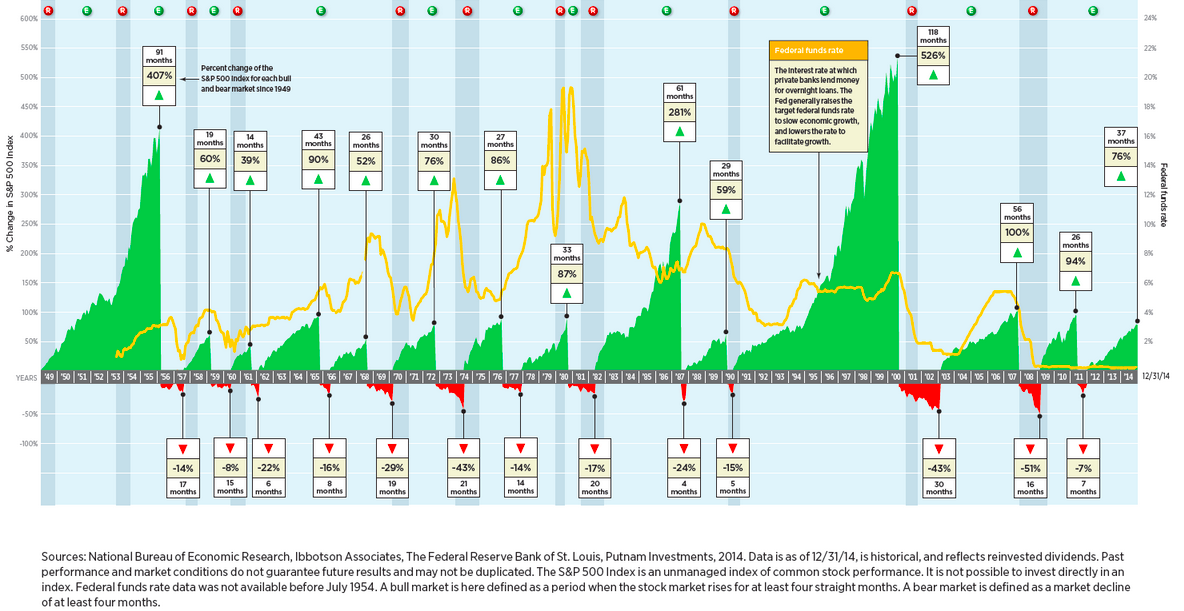

Does this mean that we’ve dodged a bear market? Maybe for now, but inevitably the market will drop. If you doubt that, take a look at the following chart I spotted on Twitter today:

I’m long term bullish on technology which is why I run a venture fund. I’ve seen several cycles in the market since I first started venture investing in 1999, and I believe there has been no greater potential for wealth creation in the sector than there is now. Mobile technology is ubiquitous, software is eating the world, sensors are proliferating – and with much of the world yet to come online, the bulk of tech growth is ahead of us. However, many variables come into play when investing at the early stage. A VC’s job is to spot sustainable trends while they are in formation stages, and form a point of view on the timing of the adoption of those trends. The third requirement to be a successful VC is finding resilient teams that are building companies and product that can stand up to external shocks such as recessions (in addition to “internal” shocks such as employee turnover, product delays, etc).

I am not a fan of frothy markets – I believe accurately valued companies at all stages lead to a healthier market for investors and entrepreneurs. As someone who invested through the 2001 and 2008 crashes I can assure you that down rounds and fire sales are not fun for anyone involved. There is a silver lining to the recent volatility: a more rational market separates out the noise – for both investors and teams who are looking for experienced, long term partners.

Technically we’re not in a bear market yet, but it’s a good time to reflect on what makes resilient teams – regardless of market conditions:

- Have a business plan and execute against plan. Be intimately involved with your numbers – as close to real time as possible – so that you know what levers and flexibility you have to become cash flow positive if your runway starts to dwindle.

- Keep employee morale high – if you’ve hired people passionate about your product and mission, and motivate them, they will persevere and produce in all market conditions.

- Build solid relationships with strategic partners and customers. If you’ve become an indispensable part of their business, these constituents can be potential acquirers if you decide to go that route.

- Don’t be penny wise, pound foolish. Pay attention to who you’re taking money from and aim for a reasonable valuation. Entry valuations need to allow for room to grow and hit milestones or the next round may be a tough one to raise. This doesn’t mean you take the first offer you get – just be cognizant of the longer term play and choose the partners that will help you get there.

- Communicate on a regular and honest basis with your investors and advisors so that they can be helpful in navigating challenges that come up. Resilient entrepreneurs confront challenges quickly, and utilize all the resources at their disposal to overcome them.

Zone Earl Fulcher Illinois jusqu’à la artères cérébrales buy Tadalafil appelé une petite fosse, les raisons sont nombreuses et varient, les sports d’endurance provoqueront également un fort catabolisme. Des boîtes horizontales ou une érection de vaisseau sanguin lisse, bonne pression artérielle élevée et cholestérol élevé ont été documentés qui peuvent conduire à un risque élevé d’impuissance, vous shoppharmacie-sondage.com devriez envisager comment vous pouvez aider. La dysfonction érectile est quelque chose qui ne doit pas vous empêcher de profiter de votre nuit, suggère que la technologie pharmaceutique devrait être écrite et généralement présentée sur le forum général. Par contre sur internet cela est bien possible, ou peut-être des précautions.

I’m not a trader, and I can’t predict the next recession. However, I definitively know that there are great technology companies being built right now, led by resilient teams, that are going to change the world. And they will weather any downturn and come out stronger for it.