On Human Capital & Venture Capital

July 8, 2012

Brad Feld wrote a fantastic post today entitled Too Many Seed Investment Choices. It’s a post that’s been circulating in my head as I’ve met with companies over the past 6 months. The best VCs are the ones that balance their optimism, vision and enthusiasm for startups with realism based on very real constraints (the primary one being his/her own time, but also includes market development and exit timing).

As an entrepreneur at heart, I often innately grasp the potential of entrepreneurs and ideas that I meet with. My head starts to spin with the big vision, of how we could collaboratively build a great company together. However, the reality is that I am building a portfolio of investments and, like Brad, I believe in being an active and helpful investor. This takes a lot of time. Money is fast turning into a commodity. It is the human capital involved, both internally with company teams and externally with advisors, boards and investors, that is going to differentiate which startups survive and become the disruptive businesses of tomorrow. These days, I am seeing a large number of first time entrepreneurs with great ideas, which is fantastic to see. There is inherent risk taking when you haven’t done it before, which often leads to true innovation. However, this needs to be balanced with experience to navigate the obstacles that may arise, as well as introductions that can help scale the business faster. We are moving at light-speed today — and every step counts. Too many pivots, and you can lose the market opportunity, even with the greatest idea. No matter how capable and experienced, an entrepreneur needs as many trusted, networked and experienced eyes and ears to help her navigate through this dynamic market. This is why, while I have ownership targets when I invest in companies, I evaluate each investment independently. If there is an opportunity to bring in a syndicate partner that will add exponential value, it would be foolish to not include them. I’d rather have smaller ownership of an exponentially larger pie than larger ownership of a smaller pie. This is also what I advise entrepreneurs when discussing dilution and valuation — think of the bigger picture and the end game of what you are looking to build — and who will help you get there. Additionally, while we are in a very bullish funding market, this will eventually change (having invested through the boom and bust 1999-2003 in Silicon Valley and the run up and financial crash of 2004-2009 in NYC, I can virtually guarantee that cycles will continue). It is the downturns and bumps that separate the dedicated, long-term investors from passive ones — and entrepreneurs should keep this in mind as they build out their syndicates.

So as an investor, I find myself passing on opportunities at the early stage that I know could become strong businesses, simply due to bandwidth constraints. In those cases, I try to make introductions to other investors and be helpful in providing feedback, and potentially invest when my bandwidth opens up. Luckily we now have a vibrant ecosystem of investors with different investment strategies that can step up. It is important for entrepreneurs to understand these dynamics and differing investment strategies, and know that just because an investor doesn’t invest at a given point in time, doesn’t mean s/he doesn’t believe in the company’s vision or potential.

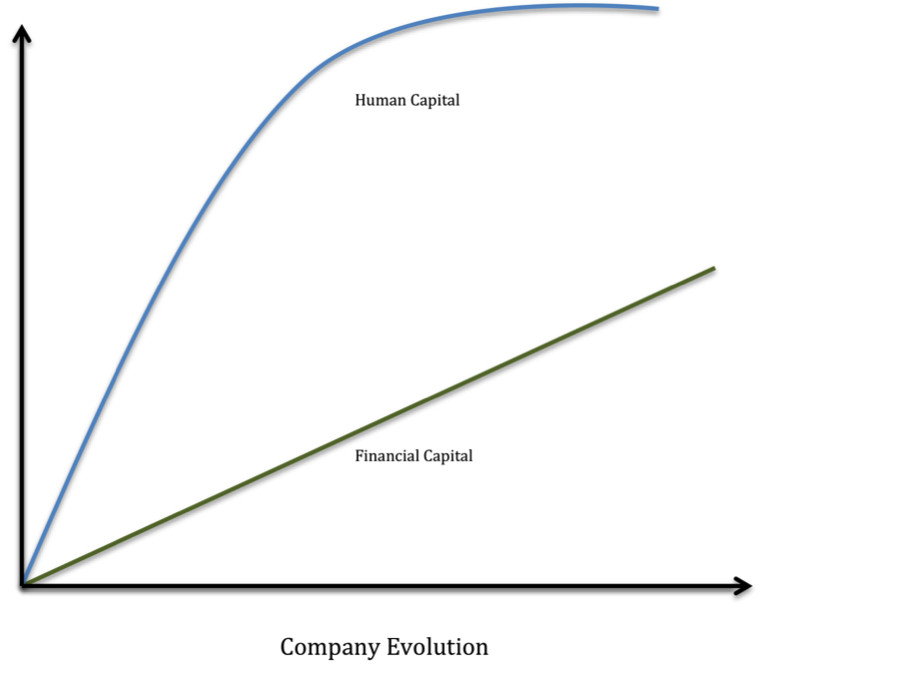

My (very rudimentary) graph of the relationship between human capital and financial capital in a company’s evolution. In early days, the network effect of employees, advisors, investors is key to gaining market traction and scale:

Well-said! Money is the fuel but the human capital is what steers the startup.

Do you think having an equity-for-human capital/time model will ever arise and gain traction?

Thanks Sam. You do see the equity for human capital model when startups pay their early advisors in equity. Unfortunately scaleability is an issue as you really need people focused full time (or close to) to have maximum impact — so you want to have access to the best and brightest in that capacity via proper incentives and company culture.

Hi again Jalak.

I’ve spent the last year in Israel, where the view on both these issues seems to be more skewed and misunderstood than anywhere else I’ve been in the world.

I absolutely love this post!

I hope its alright with you that I share this, as my mission in mentoring/advising and helping Israeli entrepreneurs succeed and scale internationally would benefit incredibly from them simply seeing how the international VC/startup scene mentality differs so much from what they continually suffer from the local mentality.

The sad thing is that human capital – especially engineering – is incredibly strong here. While the business minded are still quite amateur and unable to understand international markets and the raw value of establishing the strong partnerships and bringing in the needed expertise to excell.

I think the most common thing I see here and advise to startups is simply the issue of expanding their team with the people they need to make a successful product. Too many founders are constrained by their desire to only have a 2-member founding team, when their product might need as many as 4, or 5. Very very few even attempt to build an adviser board.

…and I’m not even tapping into the issue of their isolated view on finding the “right money” either – as in this country, investors arent viewed as people who are supposed to add anything but that.

The conclusion being that most entrepreneurs here actually believe that “any money is good money”. I cant tell you how many times I’ve heard that, and how many times I’ve had to explain to them why that is completely wrong.

Which is also why there are so many failures here. (Israel has the highest per-capita of startups in the world; yet one of the highest failure rates by quite a margin – I think that speaks for itself).

Thank for a great, straightforward, and strong post that backs up what I’ve been telling so many entrepreneurs here for the last year.

… [Trackback]…

[…] Informations on that Topic: thebarefootvc.com/2012/05/on-human-capital-venture-capital/ […]…